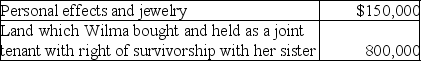

Following are the fair market values of Wilma's assets at her date of death:  The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

The executor of Wilma's estate did not elect the alternate valuation date.The amount includible in Wilma's gross estate is

A) $150,000.

B) $550,000.

C) $800,000.

D) $950,000.

Correct Answer:

Verified

Q23: Taxpayers can avoid the estate tax by

Q32: Identify which of the following statements is

Q37: On March 1,Bart transfers ownership of a

Q38: In February of the current year,Tom dies.Two

Q42: Mary creates and funds a revocable trust.

Q45: Betty dies on February 20, 2013. Her

Q50: Melissa transferred $650,000 in trust in 2006:

Q54: Which of the following circumstances would cause

Q58: Identify which of the following statements is

Q60: Proceeds of a life insurance policy payable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents