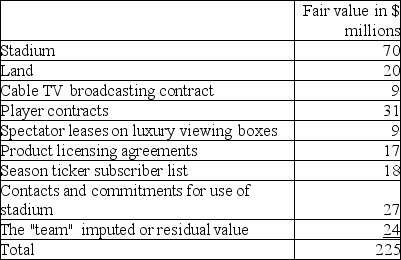

A professional sports team and related items (including a stadium)were bought by an exceedingly wealthy investor and sports fan.The negotiated price was $225,000,000.Details of what was purchased and the agreed fair values are as follows:

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years.It was these losses that prompted the last owner to sell the team and related assets.

Required:

a.Of the $225 million purchase price,how much of it relates to tangible assets? What percentage of the purchase price relates to tangible assets?

b.Describe the nature of the future economic benefits associated with each of the intangible assets acquired.For example,for the cablevision broadcasting contract,this would be the present value of the future payments expected from contracts for the broadcast of games on cablevision channels plus potential renewal contracts thereafter.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: What is economic profit as it would

Q24: A professional sports team and related items

Q24: What are the unique features that lead

Q25: Which of the following statements is correct

Q26: Explain how earnings can be manipulated through

Q28: Which statement is not correct?

A)Assessing the useful

Q29: Explain the accounting for internally developed intangible

Q34: Listed below are several transactions that occurred

Q36: Why is it important to understand the

Q39: Listed below are several transactions that occurred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents