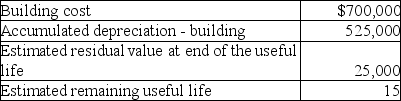

At December 31,2018,the following data were available for a building owned by Omega Company:

A small room was built on the back of the building at a cost of $45,000.The room was completed on June 30,2019 and was used as office space commencing July 2,2019.The company uses straight-line depreciation,and accounts for partial years using the number of months the asset is available for use.

Required:

How much is the impact of this expenditure on income before taxes for 2019?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Scandsia Ltd.owns a machine that it purchased

Q82: A machine was acquired on January 1,2018

Q83: AccountingPro purchased equipment on January 1,2015 for

Q83: Explain the accounting purpose of "depreciation." Does

Q86: Discuss how a company can manipulate earnings

Q89: ReelGood Corp.purchased equipment on January 1,2018 for

Q90: The following entry was recorded by Woodrow

Q91: Which question arises at the time property,

Q94: Explain how the depreciation method should be

Q95: When is property, plant, and equipment (PPE)not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents