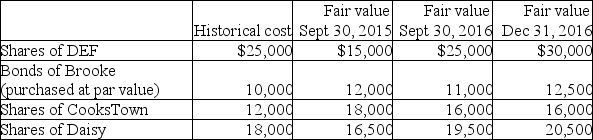

Amacon Corporation has the following investments at December 31,2016:

Amacon,whose year-end is Sept.30,purchased the share of Daisy on January 1,2015.If Amacon irrevocably elected to classify its investment in Daisy at fair value through OCI,what amount will be reported in other comprehensive income at September 30,2016?

A) $1,500 gain.

B) $2,500 gain.

C) $3,000 gain.

D) $19,500

Correct Answer:

Verified

Q65: What should an investment in a debt

Q72: Fisher Corporation has the following investments at

Q74: Fisher Corporation has the following investments at

Q76: Amacon Corporation has the following investments at

Q76: What factor is important in classifying an

Q77: Which investment could be classified at amortized

Q79: Fisher Corporation has the following investments at

Q80: Satellite Corporation has the following investments at

Q81: Tingalo Inc.purchased three equity investments during the

Q82: On January 25,2016,Mulroney Ltd.purchased 100 common shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents