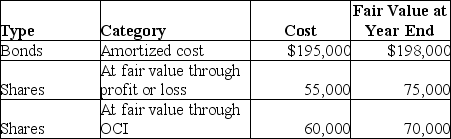

Quick Investment Company (QIC) began operations on January 1,2016.It acquired the following investments:

QIC earned interest of $12,000 during 2016.Dividends of $16,000 were declared on the FVPL shares it owned during 2016.Of that amount,$9,000 was received in December 2016 and $7,000 was received in January 2017 (note that the ex-dividend date for these shares was prior to the end of the year) .How much would QIC's total income from its investments be on the profit or loss portion of its statement of comprehensive income for the year ended December 31,2016?

A) $21,000

B) $28,000

C) $48,000

D) $58,000

Correct Answer:

Verified

Q90: Other comprehensive income includes which of the

Q93: McGyer Limited invests its excess cash in

Q94: On January 1,2015,Anny Marine Supplies purchased a

Q95: On January 1,2016,CC Company acquired 60,000 shares

Q96: Nevill Corp invests in short term investments.The

Q99: Sheila Investment Company (SIC)began operations on January

Q99: Explain the nature of and the appropriate

Q101: On January 1,2017,a company paid $100,000 to

Q102: On January 1,2017,a company paid $100,000 to

Q103: Willow Corp.is a real estate developer with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents