Copi Corp.purchased a bond with a maturity value of $60,000 payable in five years.These bonds have a 7% coupon rate payable annually.Copi paid $65,195 for these bonds,giving a yield of 5%.

Required:

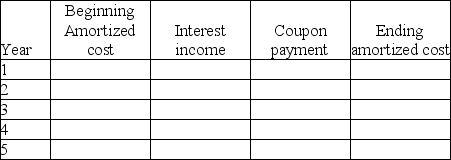

Prepare an amortization schedule that shows the amortized cost of this bond at the end of each of five years and the amount of interest income for each of those five years.

Correct Answer:

Verified

Q123: Star Corp. purchases a $100,000 face value

Q128: On January 1,2016,the Polka Dot Company acquired

Q129: On January 1,2016,CC Company acquired 60,000 shares,representing

Q130: On January 1,2015,Cadance Company purchased bonds with

Q130: A bond has a maturity value of

Q131: On January 1,2017,The Freedom Company purchased a

Q133: A bond has a maturity value of

Q134: Simply purchases a $100,000 face value bond

Q135: Bountiful Corporation has the following investment portfolio

Q137: Koala had the following transactions relating to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents