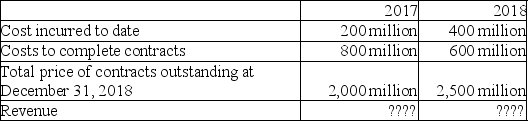

Coral Corporation builds large cruise ships on a contract basis.The company uses the percentage of completion method of revenue recognition.The following information pertains to the construction contracts it had in place as of its December 31,2018 year-end.

Required:

a.Calculate the revenue to be recognized in 2017 and in 2018.

b.While examining the Coral financial statements,the auditors noted that there was an error in the estimate of costs to complete the contracts in 2017.The cost to complete should have been $600 million instead of $800 million.Explain how this would be accounted for in the financial statements.

c.In light of the evidence noted in (b),how much revenue should be recognized in 2018?

Correct Answer:

Verified

2017: $400 million

(Percent complete ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: What are three exceptions to the use

Q98: On July 1,2017,Cusak Construction Company Inc.contracted to

Q100: Smile Operators entered into a contract to

Q101: Apartment King (AK)is building a luxury condominium

Q102: Destiny Apartments Inc.(DA Inc. )is building a

Q104: Creation Construction Company (CCC)has contracted to build

Q105: Community Apartments Inc.(CA Inc. )is building a

Q106: In early 2015,Ecotravel Corp.won a contract to

Q107: Buildings Ltd.is constructing a residential building in

Q108: ACME is investing in a new heavy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents