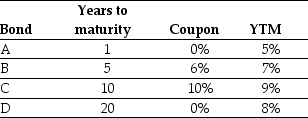

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-The percentage change in the price of the bond "A" if its yield to maturity increases from 5% to 6% is closest to:

A) -4%

B) -6%

C) -1%

D) 4%

Correct Answer:

Verified

Q30: Which of the following statements is FALSE?

A)If

Q42: Use the following information to answer the

Q44: Consider a zero coupon bond with 20

Q47: If you sell this bond now,the internal

Q49: Use the table for the question(s)below.

Consider the

Q51: The discount rate that sets the present

Q54: Consider a zero-coupon bond with 20 years

Q56: Consider a corporate bond with a $1000

Q57: If a bond is currently trading at

Q59: Use the table for the question(s)below.

Consider the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents