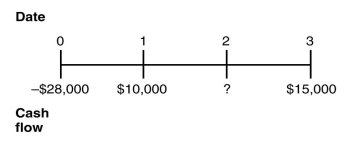

You are offered an investment opportunity that costs you $28,000,has an NPV of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:

The missing cash flow from year 2 is closest to:

A) $12,500

B) $12,000

C) $13,000

D) $10,000

Correct Answer:

Verified

Q70: Suppose that you deposit $10,000 in an

Q71: Define the following terms:

(a)perpetuity

(b)annuity

(c)growing perpetuity

(d)growing annuity

Q72: Use the information for the question(s)below.

Suppose that

Q73: The British government has just issued a

Q78: Use the information for the question(s)below.

Assume that

Q78: Francisco d'Anconia is considering an investment opportunity

Q79: If the current rate of interest is

Q79: Assume that you are 30 years old

Q80: Which of the following is NOT a

Q81: After your grandmother retired,she purchased an annuity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents