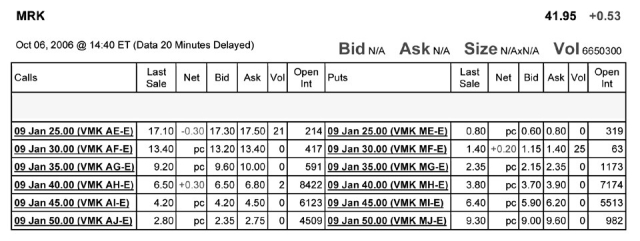

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume it is now January of 2007 and the current risk-free interest rate is 1%.Using Put-Call Parity and the January 30 option (ask price) ,estimate the relative contribution of the near-term dividends to the value of Merck's stock.

A) $4.89

B) $2.35

C) $4.30

D) $20.19

Correct Answer:

Verified

Q21: Rose Industries is currently trading for $47

Q26: Graph the payoff at expiration of a

Q27: Use the figure for the question(s)below.

Q29: You pay $3.25 for a call option

Q30: Consider the following equation: C = P

Q31: Which of the following statements is FALSE?

A)The

Q32: An option strategy in which you hold

Q34: Which of the following will NOT increase

Q36: KD Industries stock is currently trading at

Q38: Luther Industries is currently trading for $27

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents