Use the following information to answer the question(s) below.

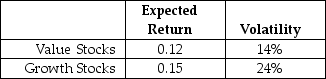

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

A) Investors have homogeneous expectations regarding the volatilities,correlation,and expected returns of securities.

B) Investors have homogeneous risk adverse preferences toward taking on risk.

C) Investors hold only efficient portfolios of traded securities,that is portfolios that yield the maximum expected return for the given level of volatility.

D) Investors can buy and sell all securities at competitive market prices without incurring taxes or transactions cost and can borrow and lend at the risk-free interest rate.

Correct Answer:

Verified

Q82: Which of the following statements is FALSE?

A)Short-term

Q84: Which of the following statements is FALSE?

A)When

Q85: Use the following information to answer the

Q87: Use the following information to answer the

Q88: Use the following information to answer the

Q89: Which of the following statements is FALSE?

A)Because

Q90: Use the following information to answer the

Q92: Use the following information to answer the

Q97: Use the following information to answer the

Q100: Use the following information to answer the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents