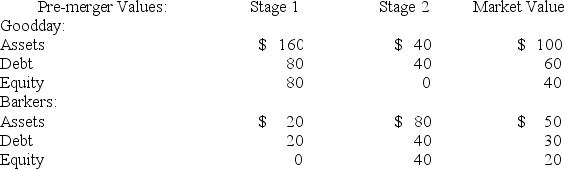

Goodday is merging with Bakers.Goodday has debt with a face value of $80 and Baker has debt with a face value of $40.Bakers' stockholders receive stock in the combined firm in an amount equal to the stand-alone market value of Bakers.The pre-merger values of the firms given two economic states with equal probabilities of occurrence are as follows:  What will be the gain or loss to the current shareholders of Goodday if the merger provides no synergy?

What will be the gain or loss to the current shareholders of Goodday if the merger provides no synergy?

A) −$10

B) $0

C) −$5

D) $5

E) $10

Correct Answer:

Verified

Q64: Alto and Solo are all-equity firms.Alto has

Q65: Alexandra's is being acquired by David's for

Q66: ABC and XYZ are all-equity firms.ABC has

Q67: Firm A is acquiring Firm B for

Q68: The distribution of shares in a subsidiary

Q70: Tiger's is merging with Lion's.Tiger's has debt

Q71: Cassandra's has 6,100 shares outstanding at a

Q72: Jay's has a market value of $3,600

Q73: The market values of Firm V and

Q74: Firm A is planning on merging with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents