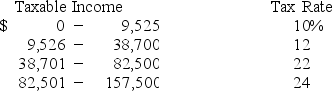

Given the personal income tax rates as shown,what is the average tax rate for an individual with taxable income of $118,700?

A) 24.00 percent

B) 22.36 percent

C) 19.00 percent

D) 21.94 percent

E) 21.00 percent

Correct Answer:

Verified

Q64: At the beginning of the year,a firm

Q65: A debt-free firm has total sales of

Q66: AC Motors is a sole proprietorship that

Q67: A firm has $820 in inventory,$3,200 in

Q68: Total equity is $1,620,fixed assets are $1,810,long-term

Q70: Assume Juno's paid $368,060 in taxes on

Q71: At the beginning of the year,long-term debt

Q72: Mart's Boutique has sales of $820,000 and

Q73: This year,Johnson Mills has annual revenue of

Q74: Awnings Inc.has beginning net fixed assets of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents