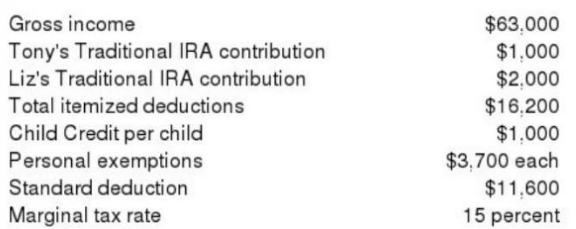

Figure 4-1

-Refer to Figure 4-1.Tony and Liz have just inherited $25,000.Which of the following statements is true?

A) The $25,000 will be taxable income in the year received.

B) The $25,000 is an exclusion for federal income taxes.

C) They should invest this money in corporate bonds to save on taxes.

D) The $25,000 will be taxable income in the year received, and they should invest this money in corporate bonds to save on taxes.

Correct Answer:

Verified

Q181: Figure 4-1 Q182: An extra benefit of a defined-contribution retirement Q183: Certain real estate losses are deductible against Q184: Figure 4-1 Q185: A way to defer income taxes to Q187: Which is not characteristic of a Coverdell Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()