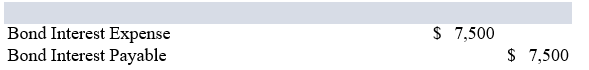

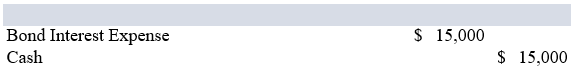

A company issued 6%, 10 year bonds with a par value of $500,000 on April 1. Interest is payable each Sept. 30 and March 31,2019. The journal entry to accrue interest expense as of December 31,2019, is:

A)

B)

C)

D)

Correct Answer:

Verified

Q52: If bonds are issued for a price

Q53: A company issues 9%, 20-year bonds with

Q54: Bonds with a face value of $200,000

Q55: A corporation paid $104,000 to retire bonds

Q56: The Premium on Bonds Payable account is

Q58: A company issues 6%, 10 year bonds

Q59: On December 31, 2019, a corporation issued

Q60: A company has $500,000 in equity and

Q61: Bonds with a face value of $450,000

Q62: A bond sinking fund investment is started

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents