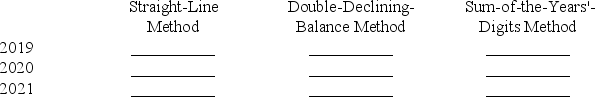

On January 2, 2019, the Hanover Company purchased some office equipment for $26,000. The equipment is expected to have a useful life of five years and a salvage value of $2,000. Prepare a schedule showing the annual depreciation for each of the first three years of the asset's life under the straight-line method, the double-declining-balance method, and the sum-of-the-years'-digits method.

Correct Answer:

Verified

SL = ($26,000-$2,000)/5 = $4,800

DDB

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: On, January 2, 2019, Rubble Sand and

Q103: Define intangible assets. List several examples of

Q104: Selected transactions of the Harrel Company are

Q105: In 2019 a mining company paid $180,000

Q106: MPG Industries purchased a new printing press

Q108: Using the information shown, calculate the depreciation

Q109: C C Coal Company purchased the coal

Q110: ASB Ceramics purchased equipment used in the

Q111: On, January 2, 2016, Rubble Sand and

Q112: On January 2, 2019, the Unit Manufacturing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents