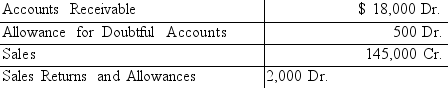

At the end of the current year, the trial balance of Tracey's Consulting Services included the accounts and balances shown below. Credit sales were $90,000. Returns and allowances on these sales were

$1,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

Correct Answer:

Verified

Q66: At the end of the current year,

Q67: The entry to record the write-off of

Q68: The adjusting entry to record estimated losses

Q69: When using the allowance method for accounting

Q70: At the end of the current year,

Q72: After the adjusting entry is made to

Q73: At the end of the current year,

Q74: At the end of the current year,

Q75: Allowance for Doubtful Accounts has a debit

Q76: Allowance for Doubtful Accounts has a debit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents