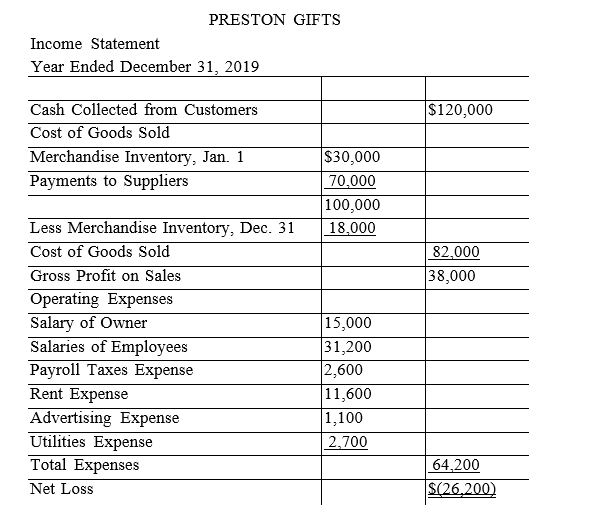

The income statement shown below was prepared and sent by Jenna Preston, the owner of Preston Gifts, to several of her creditors. The business is a sole proprietorship that sells miscellaneous gifts. An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles. Using the following additional information provided by the owner, prepare an income statement in accordance with generally accepted accounting principles.

Additional information provided by owner:

1. All sales were for cash.

2. The beginning and ending merchandise inventories were valued at their estimated selling price. The actual cost of the ending inventory is estimated to be $12,000. The actual cost of the beginning inventory is estimated to be

$20,000.

3. On December 31, 2019, suppliers of merchandise are owed $11,000. On January 1, 2019, they were owed $14,000.

4. The owner paid herself a salary of $1,250 per month and charged this amount to the Salary of Owner account.

5. A check for $800 to cover the December rent on the owner's personal apartment was issued from the firm's bank account. This amount was charged to Rent Expense.

Correct Answer:

Verified

PRE...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: Hour Place Clock Repair paid $2,400 cash

Q57: Select the statement below that correctly describes

Q58: The New York Mets received cash from

Q59: The Garrison Company offers terms of net

Q60: Spanky's Market sells organic foods and the

Q62: The _ principle requires that if income

Q63: What is meant by the concept of

Q64: The SEC has authority to define accounting

Q65: The _ principle requires important facts that

Q66: The _ assumption, which assumes that a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents