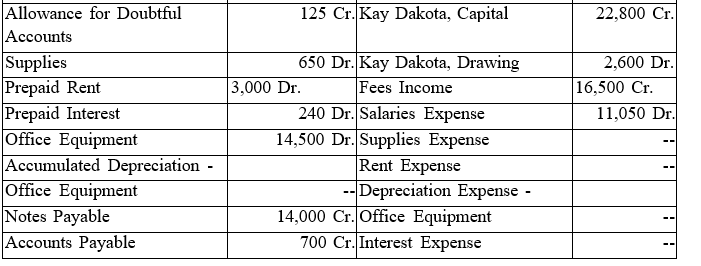

On July 31, 2019, after one month of operation, the general ledger of Dakota Consulting contained the following accounts and balances. The firm adjusts losses from uncollectible accounts only at the end of the fiscal year. Monthly adjustments are listed below. Prepare the Trial Balance, Adjustments, and Adjusted Trial Balance sections of a worksheet.

Adjustments:

(a)On July 31, an inventory of the supplies showed that items costing $250 were on hand.

(b)On July 1, the firm paid $3,000 in advance for 6 months rent.

(c)On July 1, the firm paid $240 interest in advance on a 3-month note that it issued to the bank.

(d)On July 2, the firm purchased office equipment for $14,500. The office equipment is expected to have a useful life of 5 years and a salvage value of

$1,000.

(e)On July 1, the firm issued a 3-month, 9 percent note for $4,000.

(f)During July, the firm received $600 from customers in advance of providing services. An Analyze of the firm's records shows that the full amount applies to services provided in July.

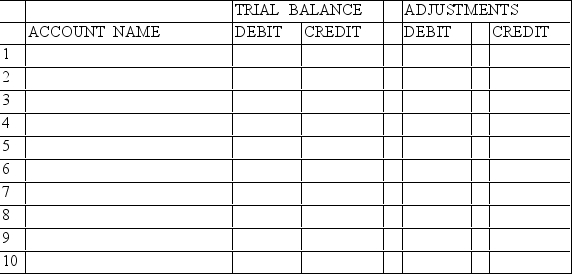

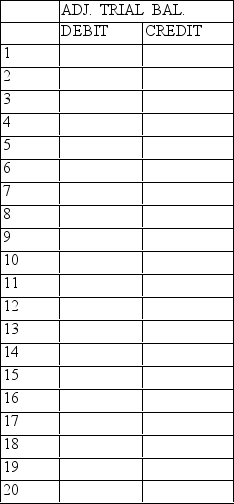

DAKOTA CONSULTING

Worksheet

Month Ended July 31, 2019

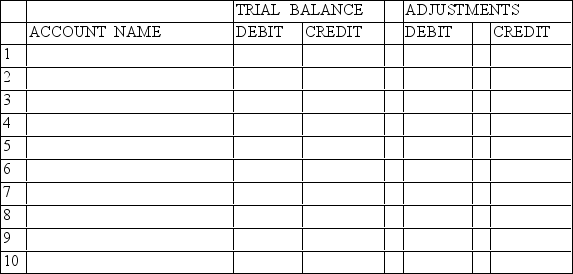

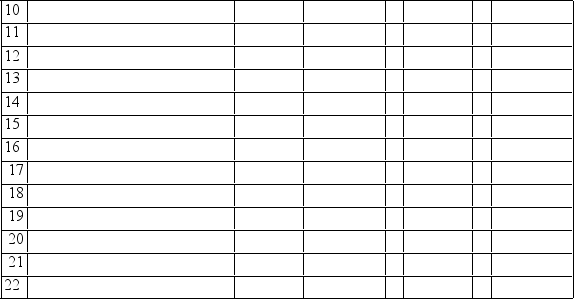

DAKOTA CONSULTING

Worksheet, continued (through Adjusted Trial Balance Column)Month Ended July 31, 2019

Correct Answer:

Verified

Worksheet

M...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: The procedure that most nearly attains the

Q79: Under a periodic inventory system, the adjustment

Q80: Uncollectible Accounts Expense is a(n)_ account.

Q81: Determine the account and amount to be

Q82: Determine the account and amount to be

Q84: Determine the account and amount to be

Q85: Design Home Furnishings is a retail store.

Q86: Determine the account and amount to be

Q87: Determine the account and amount to be

Q88: Determine the account and amount to be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents