Jackson Autos has one employee. As of March 30, their employee had already earned $6,300. For the pay period ending April 15, their employee earned an additional $2,000 of gross wages. Only the first $7,000 of annual earnings are subject to FUTA of 0.6% and SUTA of 5.4%. The journal entry to record the employer's unemployment payroll taxes for the period ending April 15, would be:

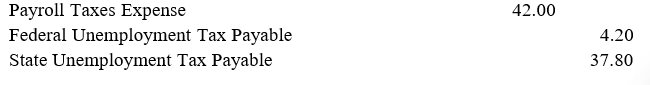

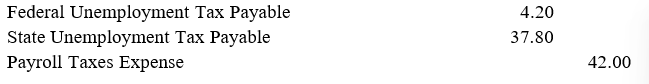

A)

B)

C)

D)

Correct Answer:

Verified

Q17: The entry to record the employer's payroll

Q18: A business pays the social security tax

Q19: Which of the following statements is NOT

Q20: Only the employer is responsible for paying

A)FUTA

Q21: Generally, the maximum earnings subject to state

Q23: All of the following taxes are withheld

Q24: To record the deposit of FUTA tax,

Q25: Employers usually record unemployment taxes at the

Q26: All of the following are internal control

Q27: Which of the following statements is correct?

A)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents