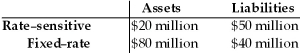

Table 23.1

First National Bank

-Refer to Table 23.1.Assuming that the average duration of its assets is five years,while the average duration of its liabilities is three years,a rise in interest rates from 5% to 10% will cause the net worth of First National to ________ by ________ of the total original asset value.

A) increase; 11%

B) decline; 11%

C) increase; 10%

D) decline; 5%

Correct Answer:

Verified

Q34: The difference between rate-sensitive liabilities and rate-sensitive

Q35: If First State Bank has a gap

Q36: If a bank has more rate-sensitive assets

Q37: If First National Bank has a gap

Q38: If a bank has a duration gap

Q40: Duration gap analysis

A) is a refinement of

Q41: Credit rationing reduces adverse selection problems.

Q42: What is the difference between credit risk

Q43: Income gap analysis and duration gap analysis

Q44: One problem with basic gap analysis is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents