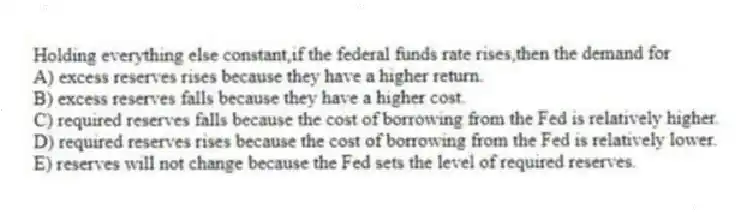

Holding everything else constant,if the federal funds rate rises,then the demand for

A) excess reserves rises because they have a higher return.

B) excess reserves falls because they have a higher cost.

C) required reserves falls because the cost of borrowing from the Fed is relatively higher.

D) required reserves rises because the cost of borrowing from the Fed is relatively lower.

E) reserves will not change because the Fed sets the level of required reserves.

Correct Answer:

Verified

Q4: Under usual circumstances,an increase in the discount

Q5: The monetary base consists of

A) currency in

Q6: The supply curve for reserves is _

Q7: The supply curve for reserves shifts to

Q9: Bank reserves can be categorized as

A) vault

Q10: A discount loan by the Fed to

Q11: If the Fed increases reserve requirements,the demand

Q12: The federal funds rate is

A) the interest

Q13: If the Federal Reserve wants to lower

Q57: The actual execution of open market operations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents