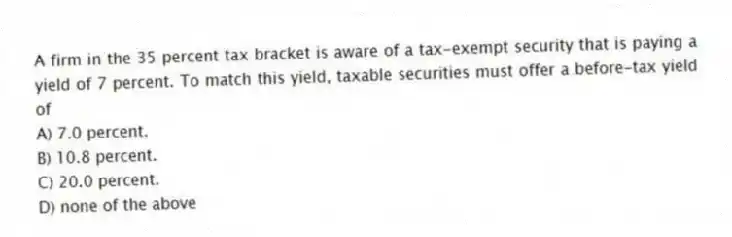

A firm in the 35 percent tax bracket is aware of a tax-exempt security that is paying a yield of 7 percent. To match this yield, taxable securities must offer a before-tax yield of

A) 7.0 percent.

B) 10.8 percent.

C) 20.0 percent.

D) none of the above

Correct Answer:

Verified

Q2: Credit (default)risk is likely to be highest

Q2: Assume investors are indifferent among security maturities.

Q6: Holding other factors such as risk constant,

Q6: Assume that annualized yields of short-term and

Q8: Some financial institutions such as commercial banks

Q9: Assume an investor's tax rate is 25

Q10: Interest rate movements across countries tend to

Q12: In general, securities with _ characteristics will

Q14: If a security can easily be converted

Q32: According to pure expectations theory, if interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents