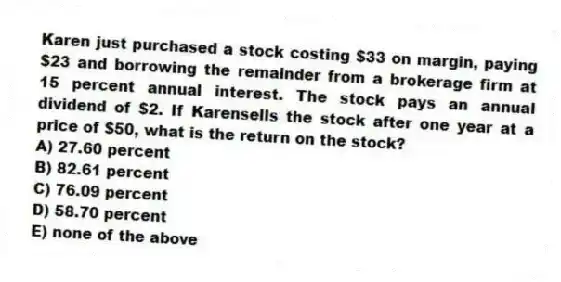

Karen just purchased a stock costing $33 on margin, paying $23 and borrowing the remainder from a brokerage firm at 15 percent annual interest. The stock pays an annual dividend of $2. If Karensells the stock after one year at a price of $50, what is the return on the stock?

A) 27.60 percent

B) 82.61 percent

C) 76.09 percent

D) 58.70 percent

E) none of the above

Correct Answer:

Verified

Q1: _ are enforced to restrict the amount

Q3: Assume that a stock is priced at

Q5: When investors buy stock with borrowed funds,

Q8: Investors can reduce their risk by purchasing

Q13: Which of the following statements about program

Q14: A short seller

A) anticipates that the price

Q15: Under the present margin requirements, at least

Q18: Which of the following statements is incorrect?

A)

Q19: Mark would like to purchase a stock

Q21: _ may facilitate stock transactions by taking

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents