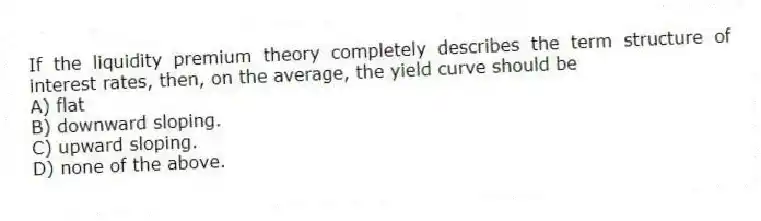

If the liquidity premium theory completely describes the term structure of interest rates, then, on the average, the yield curve should be

A) flat

B) downward sloping.

C) upward sloping.

D) none of the above.

Correct Answer:

Verified

Q62: Because interest rates may vary significantly across

Q63: If interest rates are expected to decrease,

Q66: Bonds issued at different times by the

Q69: Assume that the Treasury experiences a large

Q70: A flat or inverted yield curve is

Q71: All other characteristics being equal, securities with

Q72: The segmented markets theory suggests that although

Q72: If the Treasury uses a relatively large

Q76: The yields of securities commonly move in

Q80: When expectations theory is combined with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents