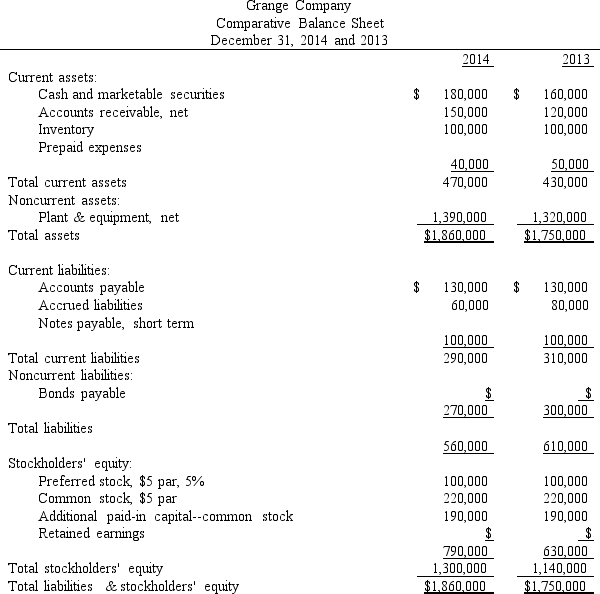

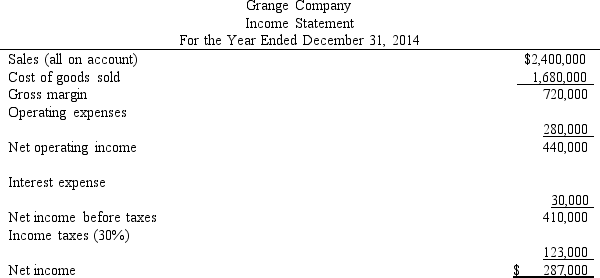

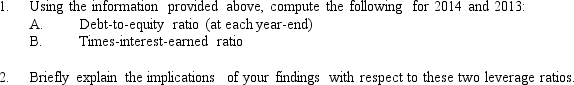

Figure 16-2.Financial statements for Grange Company appear below:

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

Dividends during 2014 totaled $127,000, of which $5,000 were preferred dividends.The market price of a share of common stock on December 31, 2014, was $100.

-Smith Inc. is a wholesaler of snow skiing gear. During 2014, Smith expanded its retail business by adding over 50 shops. The following information is obtained from the comparative financial statements included in the company's 2014 annual report.

Correct Answer:

Verified

Q162: Assuming a starting point of a 1:1

Q163: Figure 16-6

London Company provided the following income

Q164: Figure 16-2.Financial statements for Grange Company appear

Q165: Presented below are selected data from

Q166: Presented below are selected data from

Q168: Figure 16-6

London Company provided the following income

Q169: Figure 16-2.Financial statements for Grange Company appear

Q170: Figure 16-3.The current asset section of

Q171: Figure 16-2.Financial statements for Grange Company appear

Q172: Figure 16-2.Financial statements for Grange Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents