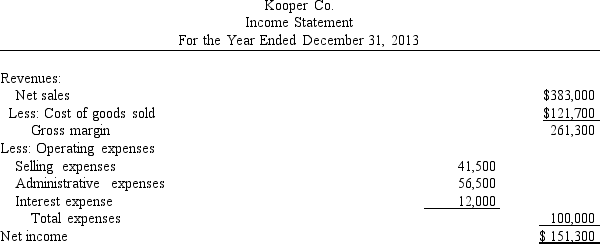

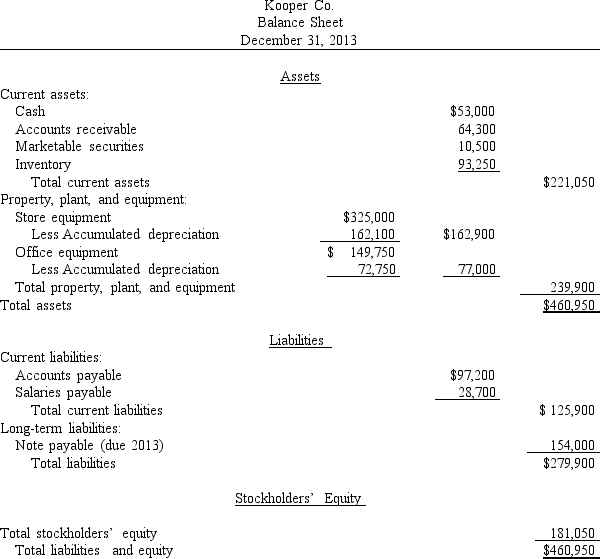

Figure 16-7

There were 30,000 shares of common stock outstanding throughout 2013. Dividends on common stock amounted to $21,000 and dividends on preferred stock amounted to $30,000. The market value of a share of common stock was $36 at the end of 2013. The income tax rate is 40%. The accounts receivable and inventory accounts had beginning balances of $58,500 and $101,400 respectively. Total assets at the beginning of the year were $430,500.

There were 30,000 shares of common stock outstanding throughout 2013. Dividends on common stock amounted to $21,000 and dividends on preferred stock amounted to $30,000. The market value of a share of common stock was $36 at the end of 2013. The income tax rate is 40%. The accounts receivable and inventory accounts had beginning balances of $58,500 and $101,400 respectively. Total assets at the beginning of the year were $430,500.

-Refer to Figure 16-7.

Required: Calculate the following ratios:

A. Debt ratio

B. Debt-to-equity ratio

State what information each ratio is providing to the company.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q160: Why is liquidity important for businesses?

Q182: Carter Company has a return on total

Q183: The use of estimates, cost, alternative accounting

Q184: Ratios by themselves tell little about the

Q185: Figure 16-4.Condensed financial statements for Black Company

Q186: Figure 16-4.Condensed financial statements for Black Company

Q187: Figure 16-7 Q189: The two major forms of common-size analysis Q190: What do profitability ratios measure and what Q191: Figure 16-7

![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents