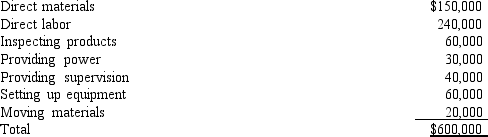

Foster Industries manufactures 20,000 components per year. The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster, inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount. An outside supplier has offered to sell the component for $25.50.

If the component is not produced by Foster, inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount. An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

A) $25,000 increase

B) $45,000 increase

C) $90,000 decrease

D) $90,000 increase

Correct Answer:

Verified

Q83: Walton Company manufactures a product with the

Q84: The operations of Knickers Corporation are divided

Q85: Boone Products had the following unit costs:

Q86: Vest Industries manufactures 40,000 components per

Q87: Stars Manufacturing Company produces Products A1, B2,

Q89: Vest Industries manufactures 40,000 components per

Q90: The following information relates to a product

Q91: Gundy Company manufactures a product with the

Q92: The operations of Smits Corporation are divided

Q93: Miller Company produces speakers for home stereo

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents