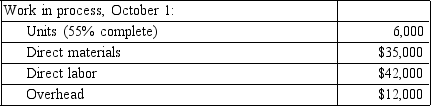

Figure 6-3.Kelley Inc., manufactures a product that passes through two processes: mixing and molding. All manufacturing costs are added uniformly in the mixing department.Information for the mixing department for October follows:

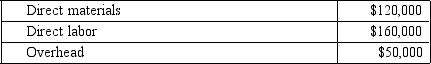

During October, 32,000 units were completed and transferred to the molding department. The following costs were incurred by the mixing department during October:

During October, 32,000 units were completed and transferred to the molding department. The following costs were incurred by the mixing department during October: By October 31, 3,000 units that were 75% complete remained in Mixing. Kelley uses the weighted average method.

By October 31, 3,000 units that were 75% complete remained in Mixing. Kelley uses the weighted average method.

-Refer to Figure 6-3. Kelley's total costs to account for would be

A) $304,000.

B) $264,000.

C) $419,000.

D) $155,000.

Correct Answer:

Verified

Q127: The cost of a department's transferred-in goods

Q130: Assuming conversion costs represent a single category,

Q131: Figure 6-7.Geller Manufacturing uses a process cost

Q133: Figure 6-3.Kelley Inc., manufactures a product that

Q134: Figure 6-3.Kelley Inc., manufactures a product that

Q136: Figure 6-3.Kelley Inc., manufactures a product that

Q137: Figure 6-2.The Bing Corporation produces a product

Q138: Figure 6-4.The following information is available for

Q139: Conversion costs include:

A) direct labor and overhead.

B)

Q140: Figure 6-2.The Bing Corporation produces a product

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents