Gainesville Truck Center

This company has a weekly payroll of $10,000 for its employees who work Monday through Friday. Federal and state income taxes are withheld in the amounts of $1,700 and $400, respectively, and FICA taxes are withheld at a mandatory rate of 7.65% (6.2% for Social Security and 1.45% for Medicare) . In addition, the federal and state unemployment taxes are applied at rates of 2% and 5%, respectively. The company's year-end is December 31.

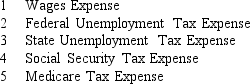

-Refer to Gainesville Truck Center. Which of the following expense accounts will be recorded as a result of this payroll transaction?

A) 1, 2, and 3

B) 1, 4, and 5

C) 2, 3, 4, and 5

D) All of the accounts are needed to record the company's payroll.

Correct Answer:

Verified

Q81: Which of the following would appear on

Q83: Which of the following would appear on

Q91: A company whose fiscal year ends December

Q96: Gainesville Truck Center

This company has a weekly

Q101: The total amount of interest that will

Q105: Which of the following statements regarding contingent

Q109: General Lighting

During the first quarter of the

Q110: A cookie company includes one premium coupon

Q120: Geiss Motorsports sold 50 motorbikes for $1,000

Q133: Refer to General Lighting. Sales taxes are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents