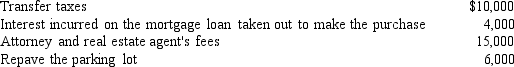

Fresh n' Fit Cuisine purchased land and a building for $320,000 so that it could open a new restaurant. The building's fair market value at the time of purchase was $220,000. In addition, the following costs were incurred prior to the restaurant's opening:  How much will be recorded as land improvements?

How much will be recorded as land improvements?

A) $25,000

B) $6,000

C) $106,000

D) $125,000

Correct Answer:

Verified

Q49: The following costs were incurred to acquire

Q54: The effect of recording depreciation for the

Q64: A company should choose a depreciation method

Q77: Which of the following factors is not

Q77: Land is not depreciated because it

A) appreciates

Q116: Refer to Fernbank Farms. What is the

Q117: Refer to Fernbank Farms. When calculating depreciation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents