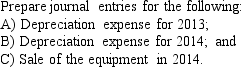

Future Foundations purchased equipment on January 1, 2013, for $50,000, with an estimated useful life of 5 years and an estimated residual value of $5,000. The company uses the straight-line method of depreciation. On July 1, 2015, the equipment was sold for $17,500 cash.

Correct Answer:

Verified

Q85: A company sold equipment at a loss.

Q86: Capitalizing an expenditure rather than recording it

Q94: Furniture Barn and Furniture World purchased identical

Q113: Fantasy Cruise Lines

On January 1, 2019 the

Q138: In 2013, Fisher Apartments purchased an apartment

Q140: A company purchased equipment at the beginning

Q141: Fantasy Cruise Lines

On January 1, 2013, the

Q144: Which of the following is an intangible

Q147: Given below are several accounts and balances:

Q148: Below are several accounts and balances from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents