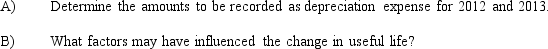

Futronics purchased a truck at the beginning of 2012 for $41,500 and decided to depreciate it over a 6-year period using the straight-line method. The estimated residual value was $5,500. At the beginning of 2013, the company determined that a 4-year life should have been used to depreciate the truck. The estimated residual value was not affected by the revision in the asset's life.

Correct Answer:

Verified

Q112: Fabulous Creations

The assets section of the company's

Q114: Fabulous Creations

The assets section of the company's

Q136: Fabulous Creations

The assets section of the company's

Q163: Farley Mills purchased new machinery at the

Q164: Explain the meaning or significance of the

Q166: Finicky Freight purchased a truck at the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents