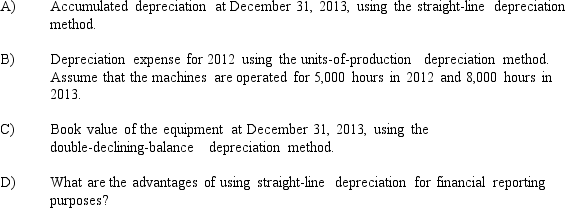

Finnegan's Fixtures purchased molding machines at the beginning of 2012 for $10,000. The machines have an estimated residual value of $2,000 and an estimated life of 5 years or 50,000 hours of operation. The company is considering alternative depreciation methods. Calculate the following:

Correct Answer:

Verified

Q127: Fabulous Creations

The assets section of the company's

Q150:

You are an entrepreneur with a

Q173: Fiona's Italian Market purchased a delivery truck

Q175: Fleet Rentals purchased equipment with a cost

Q177: Flossil Fossils Company purchased a tract of

Q179: Fanatics Company purchased a patent at the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents