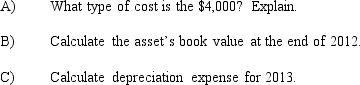

Fiona's Italian Market purchased a delivery truck for deliveries for $25,000 at the beginning of 2012. The truck has an estimated life of 5 years, and an estimated residual value of $5,000. The company plans to use the straight-line depreciation method. At the beginning of 2013, the company spent $4000 to replace the truck's transmission. This resulted in a 2-year extension of useful life, but no change in residual value.

Correct Answer:

Verified

Q127: Fabulous Creations

The assets section of the company's

Q136: Fabulous Creations

The assets section of the company's

Q168: Futronics purchased a truck at the beginning

Q169: Q172: Fields of Green, a turf farm, purchased Q175: Fleet Rentals purchased equipment with a cost Q177: Flossil Fossils Company purchased a tract of Q178: Finnegan's Fixtures purchased molding machines at the Q194: Distinguish between current assets and operating assets. Q195: Distinguish between tangible and intangible operating assets.![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents