Use the information for the question(s) below.

Kinston Industries is considering investing in a machine that will cost $125,000 and will last for three years. The machine will generate revenues of $120,000 each year and the cost of goods sold will be 50% of sales. At the end of year three the machine will be sold for $15,000. The appropriate cost of capital is 10% and Kinston is in the 35% tax bracket.

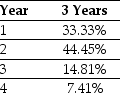

-Assume that Kinston's new machine will be depreciated using MACRS according to the following schedule:  What is the NPV of this project?

What is the NPV of this project?

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: You are considering adding a microbrewery on

Q43: Since the CCA deducted each year is

Q49: Use the information for the question(s)below.

Temporary Housing

Q51: Use the information for the question(s) below.

The

Q54: Use the information for the question(s)below.

The Sisyphean

Q56: You are considering investing $600,000 in a

Q59: Firm can make best capital budgeting decision

Q72: Use the information for the question(s) below.

Shepard

Q80: Use the information for the question(s) below.

Shepard

Q88: An exploration of the effect on NPV

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents