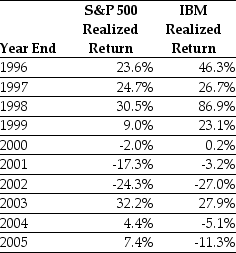

Use the table for the question(s) below.

Consider the following realized annual returns:

-The geometric average annual return on IBM from 1996 to 2005 is closest to:

A) 12.4%

B) 16.7%

C) 13.2%

D) 17.8%

Correct Answer:

Verified

Q40: If a stock pays dividends at the

Q41: Use the table for the question(s) below.

Consider

Q46: Use the information for the question(s) below.

Big

Q50: Which of the following statements is false?

A)

Q51: Independent risk is also called

A) undiversifiable risk.

B)

Q55: Use the table for the question(s)below.

Consider the

Q57: Use the table for the question(s) below.

Consider

Q58: Use the table for the question(s) below.

Consider

Q58: Use the table for the question(s)below.

Consider the

Q60: The excess return is the difference between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents