NARRBEGIN: Exhibit 2-1

Exhibit 2-1

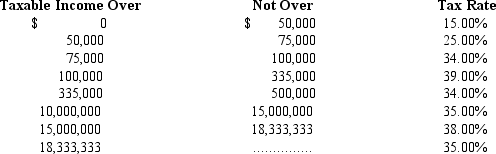

The tax schedule for corporate income is shown in the table below:

-Refer to Exhibit 2-1.Big Diesel Incorporated currently predicts taxable income of $200,000 for the next year.If this is their actual income,what will be the tax liability for Big Diesel?

A) $45,250

B) $56,500

C) $61,250

D) $91,650

Correct Answer:

Verified

Q90: The asset to equity ratio for a

Q91: What ratio measures the ability of the

Q92: Which of the following statements is FALSE?

A)

Q93: Which of the following is NOT a

Q94: A firm reports a current ratio of

Q96: Which of the following statements is FALSE?

A)

Q97: Which financial ratio measures the effectiveness of

Q98: Accountants:

A) generally construct financial statements using the

Q99: The Statement of Retained Earnings

A) reconciles the

Q100: Emmacorp reports a current ratio of 2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents