Suppose a professional sports team convinces a former player to come out of retirement and play for three seasons.They offer the player $2 million in year 1,$3 million in year 2,and $4 million in year 3.Assuming end of year payments of the salary,how would we find the value of his contract today if the player has a discount rate of 12%?

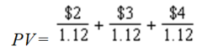

A)

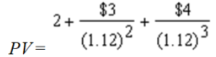

B)

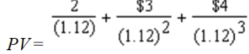

C)

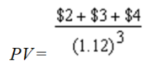

D)

Correct Answer:

Verified

Q58: If you hold the annual percentage rate

Q59: After graduating from college with a finance

Q60: Consider the following set of cashflows to

Q61: Suppose you made a $10,000 investment ten

Q62: A bank is offering a new savings

Q64: A $100 investment yields $112.55 in one

Q65: Suppose that Hoosier Farms offers an investment

Q66: Cozmo Costanza just took out a $24,000

Q67: What is the future value at year

Q68: What is the future value of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents