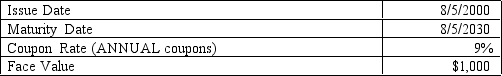

Consider the following details for a bond issued by Bravo Incorporated.  Suppose that today's date is 8/5/2004,what should the current trading price be for this bond if investors want a 12% ANNUAL return?

Suppose that today's date is 8/5/2004,what should the current trading price be for this bond if investors want a 12% ANNUAL return?

A) $658.09

B) $763.13

C) $908.88

D) $1,000.00

Correct Answer:

Verified

Q50: With respect to the company that has

Q51: You read in the financial press that

Q52: You find that the yield on a

Q53: You own a bond that pays a

Q54: The relationship between time to maturity and

Q56: You are trying to find the correct

Q57: With respect to the owner of a

Q58: If you were trying to describe the

Q59: You find that the yield on a

Q60: Fence Place Diary Company (FPD)has a 15-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents