NARRBEGIN: Normaltown Corporation

Normaltown Corporation

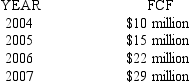

An analyst has predicted the free cash flows for Normaltown Corporation for the next four years:

-After 2007,the free cash flows are expected to grow at an annual rate of 5%.If the weighted average cost of capital is 12% for Normaltown,find the enterprise value of the firm.

A) $54.98 million

B) $301.81 million

C) $313.00 million

D) $331.43 million

Correct Answer:

Verified

Q69: The decision as to whether or not

Q70: NARRBEGIN: Normaltown Corporation

Normaltown Corporation

An analyst has predicted

Q71: For a stock pricing model,an analyst selects

Q72: After careful research,you find the present value

Q73: An investor bought a stock this morning

Q75: One of the most time-consuming aspects of

Q76: Stockholder voting rights include:

A) voting on the

Q77: A stock is expected to pay a

Q78: What term refers to the number of

Q79: Which of the following activities is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents