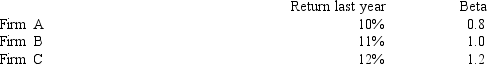

You have the following data on the securities of three firms:  If the risk-free rate last year was 3%,and the return on the market was 11%,which firm had the best performance on a risk-adjusted basis?

If the risk-free rate last year was 3%,and the return on the market was 11%,which firm had the best performance on a risk-adjusted basis?

A) Firm A

B) Firm B

C) Firm C

D) There is no difference in performance on a risk-adjusted basis

Correct Answer:

Verified

Q23: Expected returns are:

A) always positive.

B) always greater

Q24: A portfolio consists 20% of a risk-free

Q25: A disadvantage of the probabilistic approach to

Q26: NARRBEGIN: Exhibit 7-2 Q27: NARRBEGIN: Exhibit 7-2 Q29: Suppose that over the last 20 years,company Q30: An advantage of the probabilistic approach to Q31: NARRBEGIN: Exhibit 7-1 Q32: Suppose that over the last 30 years,company Q33: Suppose that over the last 25 years,company Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents

Exhibit 7-2

![]()

Exhibit 7-2

![]()

Exhibit 7-1

![]()