NARRBEGIN: NPV Profile

NPV Profile

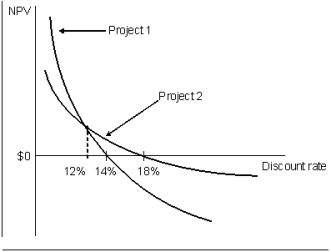

The figure below shows the NPV profile for two investment projects.

-Refer to NPV Profile.Suppose the two projects require about the same initial investment.Which project generates more cash flows in the early years?

A) Project 1

B) Project 2

C) There is no difference between the two projects

D) Cannot tell from the given information

Correct Answer:

Verified

Q30: The IRR method assumes that the reinvestment

Q31: NARRBEGIN: NPV Profile

NPV Profile

The figure below shows

Q32: NARRBEGIN: Exhibit 8-3 Invst Prpsals

Exhibit 8-3

A firm

Q33: NARRBEGIN: Exhibit 8-3 Invst Prpsals

Exhibit 8-3

A firm

Q34: Kelley Industries is evaluating two investment proposals.The

Q36: The following information is given on three

Q37: You must know the discount rate of

Q38: NARRBEGIN: NPV Profile

NPV Profile

The figure below shows

Q39: You must know all the cash flows

Q40: NARRBEGIN: Thompson Manufacturing

Thompson Manufacturing

Thompson Manufacturing is considering

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents