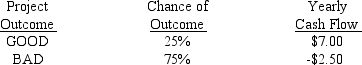

A firm is considering investing $10 million today to start a new product line.The future of the project is unclear however and depends on the state of the economy.The project will last 4 years.The yearly cash flows for the project are shown below for the different states of the economy.What is the expected NPV for the project if the cost of capital is 15%?

A) -$17.14 million

B) -$12.13 million

C) -$10.36 million

D) -$4.25 million

Correct Answer:

Verified

Q37: A firm has a capital structure of

Q38: NARRBEGIN: Bavarian Sausage Scenario

Bavarian Sausage Scenario

Bavarian Sausage

Q39: NARRBEGIN: Bavarian Sausage Scenario

Bavarian Sausage Scenario

Bavarian Sausage

Q40: NARRBEGIN: Bavarian Sausage Scenario

Bavarian Sausage Scenario

Bavarian Sausage

Q41: A firm has estimated the NPV of

Q43: Which answer describes an analysis of what

Q44: A firm has a capital structure of

Q45: A firm is considering investing $10 million

Q46: Which statement is true about a firm

Q47: Nalcoa Corp.is financing a project that is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents