NARRBEGIN: "Flip" shares 2

"Flip" shares 2

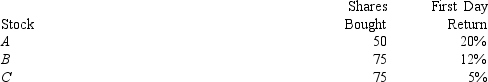

Three companies went public last month with initial public offerings (IPO) .An investor was able to purchase shares of each company at the offer price and then "flip" the shares at the end of the day for the full return.The shares of each company sold for a $20 offer price.The number of shares purchased and the first day return are shown below.

-Refer to "Flip" shares 2.What was the dollar value of the IPO investment after the first day? (Ignore any tax implications for this question)

A) $4,493

B) $4,477

C) $4,455

D) $4,400

Correct Answer:

Verified

Q65: NARRBEGIN: "Flip" shares 1

"Flip" shares 1

Three companies

Q66: NARRBEGIN: Brooks Corporation

Brooks Corporation

Brooks Corporation has just

Q67: What is the most important federal law

Q68: NARRBEGIN: "Flip" shares 1

"Flip" shares 1

Three companies

Q69: Conflicts of interest exist in the investment

Q71: Shelf registration is popular because:

A) the securities

Q72: NARRBEGIN: Brooks Corporation

Brooks Corporation

Brooks Corporation has just

Q73: NARRBEGIN: "Flip" shares 2

"Flip" shares 2

Three companies

Q74: ABC Logistics

The managers of ABC Logistics (ABC)

Q75: ABC Logistics

The managers of ABC Logistics (ABC)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents