NARRBEGIN: Tax Trade Off theory

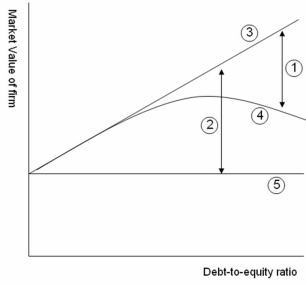

-A graphical representation of The Trade-Off Model is shown.Various components of the graph are labeled.Which of the following corresponds to line 1?

A) Present value of interest tax shields on debt

B) Present value of expected bankruptcy and agency costs

C) Value of levered firm with bankruptcy costs

D) Value of levered firm in the absence of bankruptcy and agency costs

E) Value of firm under all-equity financing

Correct Answer:

Verified

Q76: NARRBEGIN: Exhibit 12-1

Exhibit 12-1

An all-equity firm has

Q77: Lightyear Technology Corporation finances its operations with

Q78: Oak Barrel Company has net operating income

Q79: Which statement correctly describes proposition I of

Q80: One method of preventing or reducing the

Q82: Roxy International has an EBIT of $25

Q83: Louis Incorporated has EBIT of $500,000 for

Q84: Emma Incorporated has EBIT of $875,000 for

Q85: NARRBEGIN: Tax Trade Off theory

Q86: In examining the question as to whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents