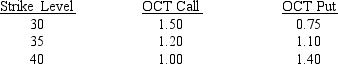

Use the following information on 13-week T-bill rate options to answer the following question(s) .

-Refer to CBOE.If you used the OCT 35 option to hedge rising rates,and the yield to maturity (YTM) on 13-week bills is 3.75 percent at the option's expiration,what is the outcome of your hedge?

A) profit of $250 per contract

B) profit of $130 per contract

C) loss of $120 per contract

D) no gain or loss,the option expires worthless

Correct Answer:

Verified

Q2: Outsource,Inc.expects a payment from a French customer

Q3: Use the following information on 13-week T-bill

Q4: A standard "fixed for floating" interest rate

Q5: The Exim Company has entered into a

Q6: You are a financial manager with JCN,Co.and

Q8: NARRBEGIN: MakeStuff Company

MakeStuff Company

The MakeStuff Company's earnings

Q9: NARRBEGIN: MakeStuff Company

MakeStuff Company

The MakeStuff Company's earnings

Q10: Suppose the spot exchange rate is 0.5491

Q11: The Exim Company has entered into a

Q12: Why might a financial manager prefer using

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents