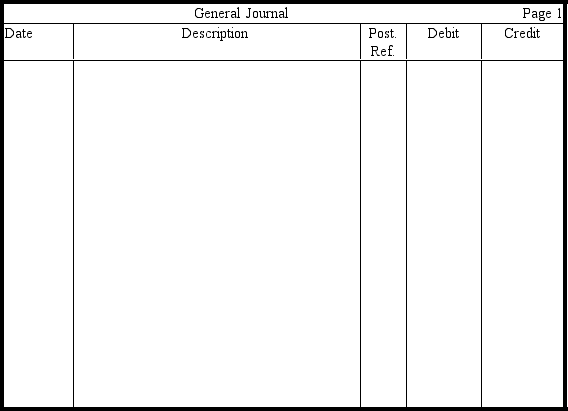

In the journal provided,prepare entries for the following independent transactions.(Omit explanations.)

a.Purchased land and a building on the land for $960,000.The appraised values of the land and building are $350,000 and $650,000,respectively.

b.Paid $5,000 for a sewage system,$15,000 for a parking lot,$1,000 to tear down a shack on land just purchased,and $10,000 for a block wall.

c.Purchased a truck two years ago for $18,000 with an original six-year estimated useful life and $3,000 residual value.After a full two years of use,revised the residual value to $4,000 and the useful life to a total of seven years.Record depreciation for year 3,assuming the straight-line method.

d.Purchased a machine on May 1,2013 (assume a calendar-year accounting period)for $15,000.The machine has an estimated life of 10,000 hours and no salvage value.Record depreciation for 2013 under the production method,assuming that the machine was used 2,000 hours.

Correct Answer:

Verified

Q206: If the purchase of machinery is treated

Q225: John Jackson obtained a ten-year sublease on

Q226: Al's Car Wash purchased a piece of

Q227: A truck that cost $80,000 and on

Q228: A company purchases land,a building on the

Q229: On January 2,2012,Vanowen Company purchased a machine

Q231: On January 1,2009,Town Spa Pizza purchased for

Q233: On January 1,2009,Tipton's Pizza purchased for $48,000

Q234: On January 1,2012,Pung Manufacturing Company purchased for

Q235: A truck that cost $29,600 and on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents