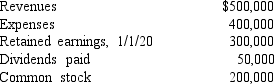

Keefe, Inc., a calendar-year corporation, acquires 70% of George Company on September 1, 2019, and an additional 10% on January 1, 2020.Total annual amortization of $6,000 relates to the first acquisition.George reports the following figures for 2020:  Without regard for this investment, Keefe independently earns $300,000 in net income during 2020.

Without regard for this investment, Keefe independently earns $300,000 in net income during 2020.

All net income is earned evenly throughout the year.

What is the controlling interest in consolidated net income for 2020?

A) $380,000.

B) $375,200.

C) $375,800.

D) $376,000.

E) $400,000.

Correct Answer:

Verified

Q43: In consolidation at December 31, 2019, what

Q44: Compute Pell's investment account balance in Demers

Q45: Compute Pell's investment account balance in Demers

Q46: In consolidation at January 1, 2019, what

Q47: The acquisition value attributable to the noncontrolling

Q49: Compute Pell's Investment in Demers account balance

Q50: In consolidation at December 31, 2019, what

Q51: Compute Pell's income from Demers for the

Q52: Compute Pell's income from Demers for the

Q53: In consolidation at December 31, 2020, what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents