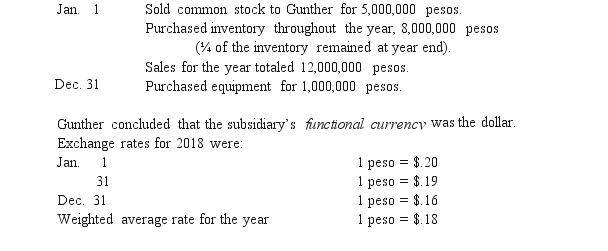

Gunther Co.established a subsidiary in Mexico on January 1, 2018.The subsidiary engaged in the following transactions during 2018:  What amount of foreign exchange gain or loss would have been recognized in Gunther's consolidated income statement for 2018?

What amount of foreign exchange gain or loss would have been recognized in Gunther's consolidated income statement for 2018?

A) $800,000 gain.

B) $760,000 gain.

C) $320,000 loss.

D) $280,000 loss.

E) $440,000 loss.

Correct Answer:

Verified

Q1: If the subsidiary's local currency is its

Q2: What amount would have been reported for

Q2: Under the temporal method, which accounts are

Q3: In accounting, the term translation refers to

A)

Q5: What exchange rate should have been used

Q5: When using the current rate method, the

Q8: What amount would have been reported for

Q10: On December 31, 2018, Westmore had accounts

Q11: What was the amount of the translation

Q17: According to U.S. GAAP, when the local

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents